What is Digital Insurance?

Digital insurance encompasses a range of technologies that have revolutionized the operations of insurance service providers. It refers to insurance companies that adopt a technology-first approach to manage the sales and administration of insurance policies.

Digital Insurance assists in risk assessment and eliminates paper-based manual processes. By integrating mobile apps, websites, and other digital channels, it enhances customer experience, offering a more convenient and accessible way to purchase, manage policies, and handle claims.

Importance of Digital Insurance

Digital insurance is reshaping the industry by delivering significant benefits for both insurers and consumers:

- Convenience: The new tech trends in insurance have made it easier to buy, organize, and renew insurance. Services are available from the comfort of the customer’s home, requiring no physical visits from the agents. It also benefits insurers with simpler communication and overall operations improvements.

- Efficiency: By reducing administrative and operational costs, digital insurance platforms can lower customer premiums. They also accommodate a diverse range of global insurance needs, benefiting insurers of all sizes, including small businesses.

- Personalization: With new technological advancements in the insurance industry like the innovation of AI tools and IoT devices, delivering custom-made insurance products and services has become easy. This personalization of services makes the customers feel more valued and helps build brand loyalty.

- Inclusivity: Digital insurance enhances the availability and affordability of coverage for underserved populations, including those in remote areas or with lower incomes, making insurance more accessible to a broader audience.

Digital insurance ensures that the insurance industry not only challenges the existing standards but also provides insurers and consumers with better, more personalized, and easily accessible services.

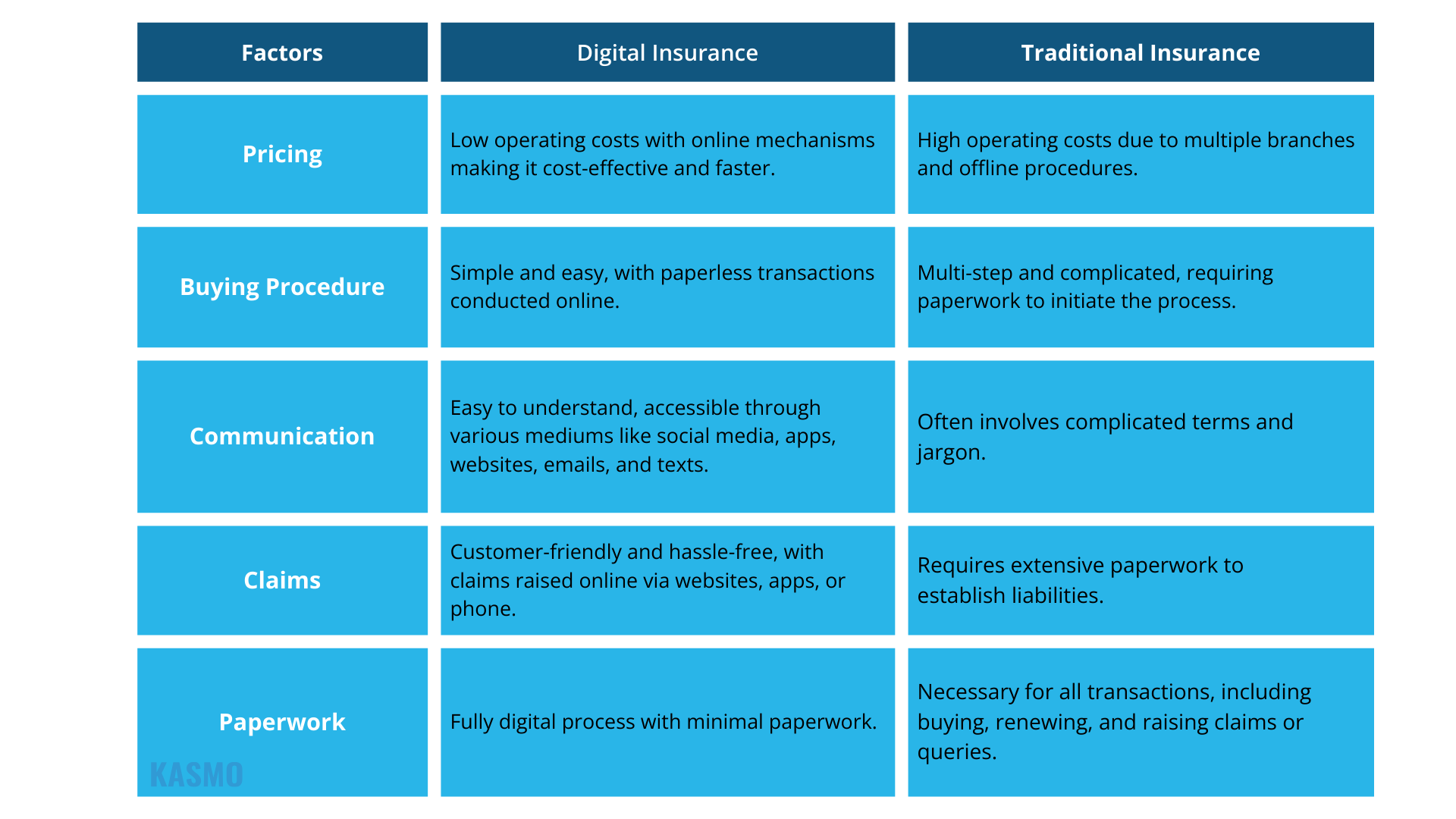

Digital Insurance vs. Traditional Insurance: A Brief Comparison

Benefits of Digital Insurance

Digital insurance is revolutionizing the insurance industry by integrating advanced data technologies. Here’s how embracing digital transformation can benefit insurers:

Cost Cutting and Improved Business Profitability

Enhanced efficiency through the effective use of data driven tools and automated underwriting and claims processing results in considerable reductions in costs and boosts profitability. Targeted marketing campaigns also add more value to financial gains by reducing inefficiency.

Enhanced Employee Productivity

Automation in manual or repetitive tasks increases efficiency of the employees to focus on working on more complex projects. It empowers the employees to work on activities such as increasing the number of self-service options – which improves operations.

Faster Cycle Times

New technology in the insurance industry also increases the speed of claim settlement, minimizing the claim settlement process. This also enhances customer satisfaction and facilitates quicker problem-solving and customer service.

Enhanced Customer Experience

Current tech trends in insurance such as AI-powered chatbots or self-service solutions provide tailored and real-time support. Kasmo’s Snowflake powered solution – OLAF provides solutions from a multitude of pre-fed documents to insurance companies in near real-time and in 107 languages. These types of innovations meet your customers’ needs by providing the quickest and most efficient forms of services, leading to brand loyalty.

Accurate Fraud Detection

Fraud detection is now easy by using predictive analytics to detect possible fraudulent claims or policy applications. This preventive measure helps curtail frauds and enhance the validity of claims.

Innovative Product Development

Through proper use of data, insurtech companies can provide insurance services that will capture customers’ demands and be at par with trends. Digital insurance is a data-driven approach that allows insurance companies to offer better rates after assessing risks.

Improved Employee Productivity

Modern digital tools, including smart dashboards and SaaS applications, enhance employee efficiency and job satisfaction. Streamlined workflows and comprehensive data systems contribute to a more productive work environment.

Cost-Effective Digital Solutions

Digital insurance platforms can be developed using low-code technologies, which simplify the creation of customized solutions while keeping costs manageable. This approach allows insurers to innovate without substantial upfront investments. Learn how Kasmo creates digital solutions leveraging Snowflake for different industries.

Top Tech Trends in Insurance Contributing Towards Digital Insurance

Let’s look at some of the top tech trends that are digitally transforming the insurance industry:

Harnessing Insurtech for Advanced Digitalization

Insurance and tech mean leveraging technologies like AI, blockchain, IoT, and NLP in insurance are transforming traditional processes. This advancement reshapes legacy insurance operations and enhances key functions such as underwriting, fraud detection, and claims management. Additionally, both insurance and tech play a vital role in addressing emerging risks, helping insurers protect their policyholders and eradicate financial risks.

Leveraging the Power of IoT and Connectivity

The insurance industry is being shaped through Internet of Things (IOT), as the physical and digital worlds merge at a fast pace. The more IoT devices are being used, the more insurance companies get a large amount and high-quality data, which helps in refining the risk assessment and the pricing of the policies.

Additionally, with its wide network of sensors and interconnected devices, insurtech companies are using 5G infrastructure to exchange information in real-time. The integration of such technologies helps in automating and managing reports of accidents and claims, expediting operations and enhancing customer experience.

Integrating Predictive Analysis and Machine Learning for Digital Insurance

Predictive analytics and machine learning are transforming the digital insurance industry. With the help of these advancements, Insurers can make a policy individually, identify risky individuals and manage their marketing approach.

For example, car insurance providers use data and predictive analytics to evaluate driving habits obtained through IIoT devices. This lets them change their premiums as well as provide a bonus for safe driving. In the same way, the use of clever algorithms in ML helps in the prevention of fraud related to claims, and the customization of policy recommendations to improve the insurance experience.

Moving Data to Cloud: The Must-Follow Trend for Digital Insurance

The trend of moving data to the cloud is accelerating, driven by the need for agility, scalability, and innovation. Snowflake’s AI Data Cloud for financial services can significantly support this transition by offering a robust, secure, and efficient platform tailored to the unique needs of the financial sector.

How Snowflake’s AI Data Cloud Benefits Financial Services:

- Enhanced Data Governance and Compliance:

Snowflake ensures stringent regulatory compliance with powerful security and governance features, including private connectivity, advanced encryption, and integration with third-party tokenization providers. This allows financial institutions to securely manage sensitive data.

- Real-Time Data Collaboration:

Snowflake facilitates secure, real-time data sharing across the enterprise and with external partners. This capability fosters innovation and growth by enabling financial services organizations to collaborate more effectively and leverage shared data insights.

- Improved Decision-Making:

By unifying scattered data sources, Snowflake provides real-time insights that enhance financial reporting, forecasting, and payment integrity. This data-driven approach improves decision-making and operational efficiency.

- AI and Machine Learning:

Snowflake’s platform supports advanced AI and machine learning applications, enabling financial services to innovate faster and create customer-centric products. This includes leveraging generative AI for new data experiences and automating complex workflows.

- Scalability and Flexibility:

Snowflake’s cloud-based infrastructure allows financial institutions to scale their operations seamlessly and adapt to changing market demands. This flexibility is crucial for supporting new business models and faster product innovation cycles.

Implementing Low-Code or No-Code Applications

In 2024, organizations will significantly adopt low-code/no-code platforms to improve the agility of insurance companies. These platforms help insurers apply and modify applications in real-time by using convenient tools without the intervention from IT department and shortens the time for delivering new products.

Key Benefits:

- Increased Agility: Enables quick building and testing of the insurance solutions with little coding, enabling efficient response to market conditions.

- Reduced IT Burden: Helps non-IT personnel to execute development processes which reduces the workload on the IT departments and directs them to more complicated issues.

- Improved Cost Efficiency: Enhance cost reduction and boost productivity.

- Enhanced Customer Experience: Enables quick delivery of services, leading to enhanced customer satisfaction.

Snowflake has introduced Cortex Analyst which requires almost no code and allows users to get detailed insights from vast amounts of data.

Role of Snowflake Cortex Analyst:

Snowflake Cortex Analyst Cortex Analyst is a fully managed, LLM-powered feature that provides advanced data analytics, seamless integration, and robust risk management in natural language. This helps insurers make data-driven decisions and create achievable goals.

- Advanced Data Analytics: Cortex Analyst leverages AI to provide deep insights and analytics in natural, easy-to-understand language, helping insurers make informed decisions based on real-time data.

- Seamless Integration: The platform supports easy integration with existing systems, ensuring a smooth transition and minimal disruption to operations.

- Robust Risk Management: Cortex Analyst includes features for comprehensive risk management, ensuring that all applications meet regulatory and security standards.

Final Thoughts

Advanced technological advancements and innovations in AI/ML tools are rapidly transforming the insurance industry. Many insurance companies have culminated insurance and tech which gave rise to digital insurance. It encompasses various technologies that have transformed the operations of insurance service providers.

Digital insurance companies prioritize a technology-first approach to manage the sales and administration of insurance policies. Utilizing AI, ML tools, IoT, and cloud services like Snowflake will rapidly build a stable architecture for insurance companies that protects them from fraudulent activities and seamlessly maintain regulatory compliances.