Introduction

A survey conducted by PwC states that after a 40% increase in financial services deal volume (number of transactions taking place) and valuations (refers to the estimated worth of the companies or assets involved in these transactions) in 2021, it is expected that many insurers will continue to take advantage of this market condition in 2025 and optimize their portfolio. Moreover, with advancements in technology and changing customer expectations it has become vital to follow the current trends in insurance industry.

In this blog, we will analyze the latest trends in insurance industry and understand how you can leverage the power of Snowflake and Kasmo’s solutions to step into the future and not get left behind your competitors.

The Current Trends in Insurance Industry: Here’s How NOT to Get Left Behind!

Previously, the major complaints among customers were – there’s not enough progress and innovation in this industry. Financial services companies and insurance companies have taken note of these complaints and are adopting new strategies to navigate any unforeseen crisis.

By leveraging data, AI and advanced cloud data platforms like Snowflake, insurance companies can meet the increasing demand of customers and offer flexible solutions to them such as premium coverages, flexible policies depending on risks associated with clients, and refund policies.

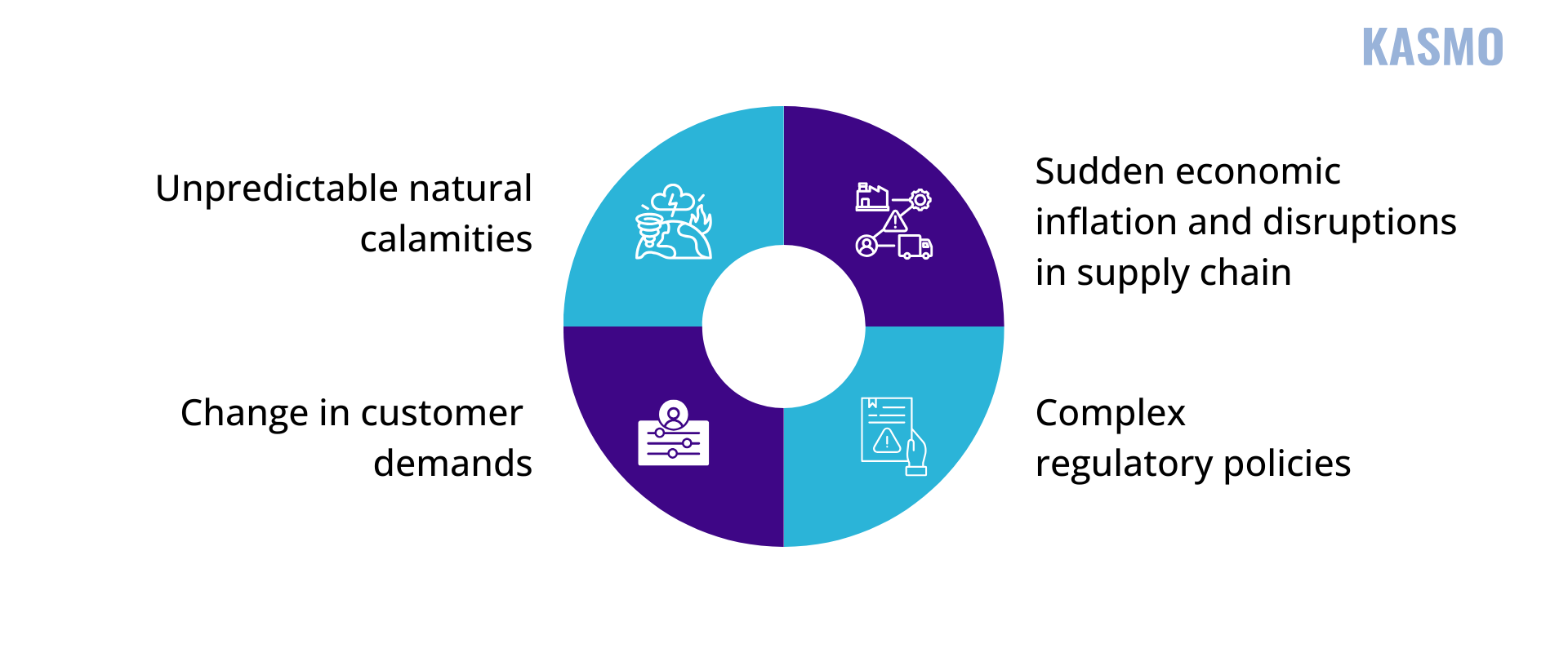

This ability to adapt quickly highlights the industry’s resilience and relevance, not only as an economic player but also as a source to protect customers and businesses alike. There are several challenges that insurers are facing now:

To help insurance companies stay on top of current trends while eliminating these complex challenges can seem impossible, but with Snowflake and Kasmo’s expertise you can see transformative results!

Current Trends in Insurance Industry You Cannot Miss!

Let’s look at some of the latest trends you need to keep in mind for 2025:

Environmental, Social, and Governance (ESG) Considerations

One of the key current trends in the insurance industry is the growing importance for Environmental, Social, and Governance (ESG) considerations. As the global focus on sustainability intensifies, insurers are expected to integrate ESG principles into their underwriting and investment strategies. Currently only 45% of insurers believe that ESG is a very important factor in their underwriting process. But with adequate awareness, more insurers can get educated on the importance of ESG.

The Pit of Mistrust

The survey conducted by PwC shows that due to a lack of trust from customers, there have been less people investing in insurance, which increased a wider protection gap and economic losses. Their analysis shows that this gap can further increase to US$1.86tn by 2025.

To avoid this pitfall, the insurance industry has refocused their strategies and now insurance companies are ensuring that the new strategies address this gap. By hopping onto this trend, you can think beyond traditional risk transfer and offer more comprehensive protection solutions to your customers. As wealth disparities and social unrest escalate, by correctly realigning your decisions, you can easily tackle the mounting pressure and bridge the widening gap, increase affordability, and expand coverage, especially in underserved regions and communities.

Make Technology and Cloud Platforms Like Snowflake Your Best Friends!

Insurers are increasingly investing in digital innovation to improve customer experience, streamline operations, and enhance risk management. The COVID-19 pandemic forced insurers to accelerate this digital shift, with many businesses moving to cloud platforms like Snowflake, implementing AI-driven tools, and automating key processes such as claims handling and underwriting.

Among the most significant technological developments is the rapid integration of artificial intelligence (AI) and data into regular operations. Integrating your overwhelming data with AI can help insurers transform how they interact with customers – from providing personalized pricing models to creating AI-powered chatbots that can handle customer inquiries 24/7. Insurers are also leveraging third-party data to improve underwriting accuracy, detect fraud, and create more personalized insurance products.

Explore Kasmo’s accelerator Olaf – a RAG-based chatbot can be customized according to your financial needs. Book a DEMO now!

Watch the Webinar Now!

Leveraging IoT – Why Insurers Need to Use Them More

One of the most popular current trends in insurance industry in 2025 is the increasing use of IoT (Internet of Things) devices. These devices, such as smart home sensors and telematics in cars, are being increasingly used to monitor risk and adjust premiums in real-time based on actual usage. This shift towards on-demand insurance and real-time pricing will further drive the adoption of digital-first models in the insurance sector.

Visit our YouTube Channel to Explore how our accelerators Olaf and Nimble Search Are Helping Global Clients.

Check out Now

The digital-first insurance model is also creating opportunities for new distribution channels. Insurers are expanding into digital platforms and adopting insurance-as-a-service business models. These models are helping insurers reach customers who may not have traditionally considered insurance, such as younger, tech-savvy generations who demand more convenience and flexibility.

Collaboration is The New Gamechanger for Insurance Industry in 2025

Insurers will need to forge new partnerships, collaborate with several tech services companies, and engage in multiple collaborations. This means that insurers will have to expand their business models beyond the existing traditional insurance models and work with partners across sectors such as healthcare, finance, and technology. Such collaboration will allow insurers to create holistic solutions that meet the diverse needs of customers.

Customer-Centricity and Personalization

The next-generation insurance models will be more customer-centric, focusing on delivering personalized products and experiences. Customers today expect tailored insurance solutions that fit their individual needs. To meet these expectations, insurers will need to leverage advanced data analytics, AI, and digital channels to offer customized policies and more proactive risk management services. Using AI responsibly will become more prevalent, helping insurers to provide customers with coverage that fits seamlessly into their daily lives without violating any data privacy regulations or compromising on sensitive customer data.

Create Advanced Risk Management Strategies

The insurance industry has a unique role to play in mitigating the risks associated with different types of customers. Insurers must develop better risk management strategies and models to account for extreme weather events, floods, wildfires, geopolitical disruptions and other unforeseen disasters. Additionally, insurers will need to work alongside governments, regulators, and other industries to create solutions that cater to customers as well as comply with regulation policies.

Workforce Transformation and Talent Acquisition

As the insurance industry adapts to digital technologies, there will be a significant shift in the human workforce. Insurance companies will need to attract more professionals with expertise in AI, data science and cybersecurity. At the same time, insurance industry leaders will need to ensure that their existing workforce is reskilled to meet the demands of the new digital age. Employee wellness and engagement will also remain priorities as industry leaders build more flexible and resilient organizational structures.

The future of the insurance industry depends not only on the ability to adapt to technological change but also on the industry’s capacity to meet societal expectations. The role of insurers in promoting transparent claims and insurance policies, tackling risk management challenges, and practicing sustainability will become more central. By keeping up with the current trends in insurance industry, your team can build a more trustworthy and resilient business framework that continues to protect and empower customers and businesses alike.

Role of Snowflake in Transforming the Future of Insurance Industry

Insurance companies still struggle with legacy, on-premise architecture and fragmented data. To combat this, Snowflake AI data cloud is one of the best choices to reshape how insurers perceive, manage, and leverage data. By leveraging this cloud data platform, you can propel your company towards an era of agility and customer-centricity.

Snowflake’s capabilities help insurers to eliminate data silos and consolidate disparate data streams into a singular, unified platform. With a single source of truth, insurers gain a 360-degree view of customer profiles, the risks associated with individual customers and their operations. This unified approach helps insurers create better risk management strategies, take data-driven decisions and create streamline claim processes for their customers. With access to a comprehensive data repository, insurers can refine risk assessments, reassess their pricing strategies, and pinpoint areas for cost reduction, solely based on data and not on mere hunch.

Additionally, Snowflake also significantly elevates risk management capabilities. In an industry where anticipating and mitigating risk is vital, the capacity to analyze extensive datasets in real-time is indispensable. Snowflake’s robust analytical tools empower insurers to discern emerging patterns, detect anomalies, and make data-driven decisions that minimize exposure and safeguard assets. This proactive approach to risk management fosters operational resilience and mitigates financial vulnerabilities.

Kasmo, a global Snowflake partner, provides our expertise to insurance companies and help them enhance customer experience, streamline operations and create better claims processes. Our experts at Kasmo have built solutions and accelerators leveraging Snowflake that will provide you with a 360-degree customer profile, facilitate personalized interactions, streamline workflows, and deliver smooth services to your customers. You can leverage our expertise and solutions to accelerate claims processing, provide tailored product offerings to your customers, and elevate customer satisfaction.

You can easily integrate diverse data sources into Snowflake without worrying about any additional cost. From underwriting and claims processing to reporting and fraud detection, this platform optimizes operations and eliminates redundancies. By facilitating seamless collaboration and data sharing, Snowflake empowers teams to work together and make rapid and data-driven decisions.

Conclusion

The current trends in the insurance industry are deeply influenced by technology, evolving customer needs, and external challenges such as climate change and global economic shifts. As we move toward the future of insurance, it is clear that digital transformation, ESG integration, and collaboration across industries will define the next phase of growth. Insurers who embrace these changes and leverage these latest trends will be well-positioned to thrive in a rapidly changing world.

A pivotal advantage of Snowflake is its access to a vast ecosystem of information. Insurers can gain deep insights into customer behavior, market trends, and risk factors. This access to external data enriches internal analyses, enabling insurers to make more informed decisions and gain a competitive edge.

Secure data sharing and seamless integration with existing workflow architectures further enhances collaboration and productivity, driving customer growth and retention. Being one of the leading data warehouses, insurers can use Snowflake to create strategic assets that empower them further to navigate the modern-day challenges and transform the future of insurance industry.

As the industry adapts, it will provide a comprehensive suite of solutions that help businesses and individuals navigate complex challenges. By addressing the widening protection gap and aligning with social and environmental goals, insurers can ensure their relevance and success in the years to come.