Introduction

Financial services firms are shifting their focus to provide more personalized services to their customers. According to a survey conducted by PwC, in 2025, 22% of financial services firms believe that digital transformation will be one of the key challenges they will need to navigate. Some more challenges faced by financial sector include regulatory compliance, increasing frequency of cyber threats, attracting new customers, declining loss of customer trust due to financial frauds, retaining old customers, climate change and other environmental factors, and lack of flexible and scalable architecture to analyze customer data for providing personalized and tailored customer services.

Practicing personalization in banking requires a solid customer DNA. This customer DNA include:

With this customer DNA, financial services firms can create personalized services. However, to optimize this customer data collated, they need a complete customer 360 in banking to understand customer profiles and take data-driven decisions. Without a complete overview of customer data, financial services will not be able to navigate their challenges.

Investing in AL and ML models helps in solving the challenges faced by the financial sector. But even after significant investments in AI, only 8% of banks can apply predictive insights from their AI/ML models to create personalized campaigns, according to research by McKinsey. So, how are the challenges faced by the financial sector solved?

The answer is simple.

Using Snowflake.

How Snowflake Customer 360 Solves the Challenges Faced by Financial Sector?

Snowflake AI Data Cloud platform is a multi-workload cloud solution that is built on cloud, for cloud. Snowflake’s Customer 360 helps financial services navigate their challenges by breaking down data silos, providing a single source of truth and analyzing customer data by masking sensitive data.

Data silos are one of the major concerns for financial leaders. Data silos not only hinder the firms’ capabilities to provide personalized customer services but also hinders the ability of employees to analyze data from third party sources. Here are some areas where data silos prevent value realization:

With Snowflake, financial services organizations can remove data silos easily and enrich their sales data with finance, ERP, IoT and third-party data, helping businesses get a detailed overview of their customers. This overview helps financial leaders gain a detailed understanding of Capital Markets credit risks and insurance risks. By understanding customers’ spending habits and financial needs, banking services can suggest credit cards and loyalty programs that better suit them.

Financial services firms have very specific objectives and goals. Financial leaders need to maintain their business and technology goals simultaneously. These firms want their services to be globally accessed by customers. With multi-currency facility enabled in Snowflake, financial leaders can stay assured that their services are easily accessed throughout the organization, stakeholders and customers.

Snowflake also helps to drive decisions strictly based on data, eliminating the need to take decisions on intuitions. This data cloud platform also helps banks and financial services to launch products and services quicker in the market, meeting customer expectations, increasing satisfaction and reducing churn.

The best part about Snowflake: pay-as-you-go model. This reduces the financial load on leaders. With its well-defined business capabilities, shared device models and advanced data architecture, it reduces TCO, downtime error and overhead expenses. The data architecture is flexible, and financial services can scale it as per their business requirements without investing in a third-party infrastructure to store the vast amounts of data.

Coming back to the technical goals of financial services firms, there are also significant challenges faced by the financial sector. Aligning their policies to state regulations and privacy policies can be challenging. Snowflake’s data governance policies help financial leaders maintain compliance. Business leaders can scale this platform horizontally with low latency.

Here are some more reasons financial services firm need to leverage Snowflake to navigate their challenges:

How Does Snowflake Build Customer DNA or Customer Overview

- It identifies and understands customer data by mapping, matching, and modeling. Snowflake data cloud platform creates and defines key subject areas and enterprise conceptual and logical data models.

- The customer data from various sources is consolidated on a single platform in Snowflake. This consolidated data includes product details previously used by the customer, account details of the customer, transaction details of the customer, and other relevant details in a centralized data repository.

- To avoid confusion, financial firms can consolidate each customer’s data in one Subject Area. Each data domain will then respectively have a domain owner that will govern the rules as and when the data is consumed or when the financial firm provides the data.

- With advanced AI/ML models, financial firms can derive analytical insights from both unstructured and structured data. This data analysis helps financial leaders to predict customer demands. This is especially useful for claim handling in insurance companies. This data analysis helps leaders understand how they can optimize their business processes.

- Data sharing is not a difficult task anymore. With Snowflake’s data-sharing capabilities, organizations can not only share data within the organization seamlessly.

- You can now use all the simplified and consolidated data in your respective Customer Data Platform (CDP), enriching customer engagement and fostering collaboration between employees and customers.

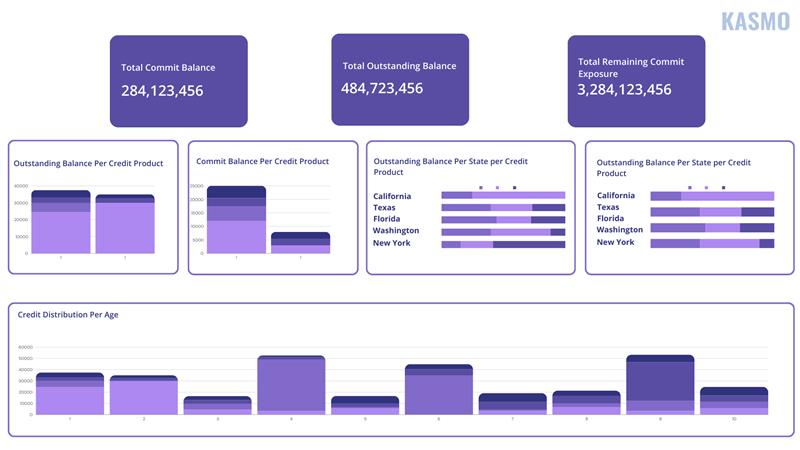

Let’s look at an example of how Snowflake provides a comprehensive view of customer data:

Benefits of Practicing Personalization in Banking and Financial Services

According to research by BCG, for every $100 billion in assets accumulated in a bank, it has the potential to achieve almost $300 million in revenue growth, just by personalizing customer interactions.

Personalization in banking and financial services provides a meaningful, individualized experience to the customers at the right time, through the most effective communication channel. In the face of new cybersecurity threats, financial services firms need to rebuild trust and foster stronger, more meaningful relationships with their customers by embracing a new, customer-first approach.

Though banking products are not frequently purchased, modern consumers like to engage with their banks almost frequently through mobile apps. This type of engagement offers banks and financial services a unique opportunity to create personalized interactions that are relevant and valuable.

Financial services that can meet increasing customer expectations can unlock new opportunities. By using data to anticipate customer needs, they are well-equipped to take on a more proactive role. Personalization also plays a crucial role in driving sales and increasing revenue.

To scale personalization across their operations and navigate challenges faced by the financial sector, leaders must rethink their internal structures and processes. This requires breaking down traditional silos between channels and products, making the customer experience the central focus of every interaction.

How Kasmo Can Help

As the premier services partner of Snowflake, Kasmo’s experts are dedicated to solving challenges faced by financial sector. With our accelerators, Kasmo has been helping clients globally eliminate their data silos, reduce downtime errors, optimize customer engagement and eliminate the need to invest in additional data warehouses with Snowflake AI Data Cloud.