According to a 2023 report by McKinsey, 65% of customers are unsure about the economic outlook for the upcoming years. Inflation has caused several concerns in people, including the rising cost of goods, savings for emergency funds, and reevaluating their relationships with financial institutions. People are moving towards banks that can provide them with better interest rates, seamless account openings, and good experiences. As the financial services landscape continues to remain volatile, improving customer service in banking becomes crucial. But why is customer service important? Let’s find out!

Importance of Customer Experience in Banking

- Building Trust and Loyalty: A primary concern for every individual is the level of trust they can develop with the organization they do business with. This is brought by the kind of customer service they receive from the banks. To sustain such a trust level, the customer service staff of the various banks must be skilled, possess the right tools, and more importantly, take through the customer’s importance. Specifically, clients who get their problems solved will not go to any other financial institutions for service. To sustain such a trust level, the customer service personnel must be skilled and understand the importance of customer service in banking.

- Competitive Differentiation: When it comes to customer service in banking, financial companies can stand out in terms of their offerings and the value provided to customers. Additionally implementing unique, simple, and easy approaches like using AI-based chatbots can help customer service personnel provide seamless service to their clients. Implementing chatbots to answer frequently asked questions, it leaves ample amount of time for employees to focus on creating personalized experiences for their clients. Learn more on OLAF – Kasmo’s gen AI chatbot solution, tailored for banking and other financial institutions.

- Reducing Customer Churn: Customer churn is also a major problem in the banking industry. Most often the causes point to the quality of services rather than the financial propositions. By focusing on tailoring experiences for customers, banks can reduce the rate of customer churn. Hiring and training customer service staff to handle any kind of unforeseen circumstances can help the financial institution retain customers. This can help the banks predict the behavior and demands of their customers, which could help them deliver those products and services that the customers are likely to appreciate and thus, would not shift to other better banks.

- Facilitating Digital Transformation: Digital change is revolutionizing the banking sector. Consumers now demand digital engagements more than actual physical interactions with the firms. Banks can provide digital facilities like mobile apps that can offer services to complement their personalized customer experiences. This approach highlights the bank’s technological progress and helps improve customer engagements. To support banks with delivering a customer-centric experience, Snowflake has developed solutions that consolidate data from multiple sources across one platform and improve collaboration and customer service in banking.

Key Strategies to Improve Customer Service in Banking

Here are 8 ways to help financial firms understand how to improve customer service in banking:

Proactive Customer Engagement

Banks should engage with customers proactively rather than waiting for major events or purchases. Effective strategies include:

- Educating Customers: Use interactive tools to inform customers about products and services, reducing the need for them to search for information.

- Notifying Customers: Keep customers updated with notifications about billing, application statuses, and important announcements.

- Surveying Customers: Collect feedback proactively to uncover unspoken needs, ensuring interactions are a two-way exchange that values their time and offers rewards for participation.

Understand Customer Journey

Mapping customer journeys involves identifying common complaints and touchpoints. Enhance live assistance by providing real-time collaboration, which helps resolve complex issues more quickly. Having direct interactions speeds up problem identification and solution delivery. Additionally addressing issues effectively at the first point of contact helps in mitigating problems effectively

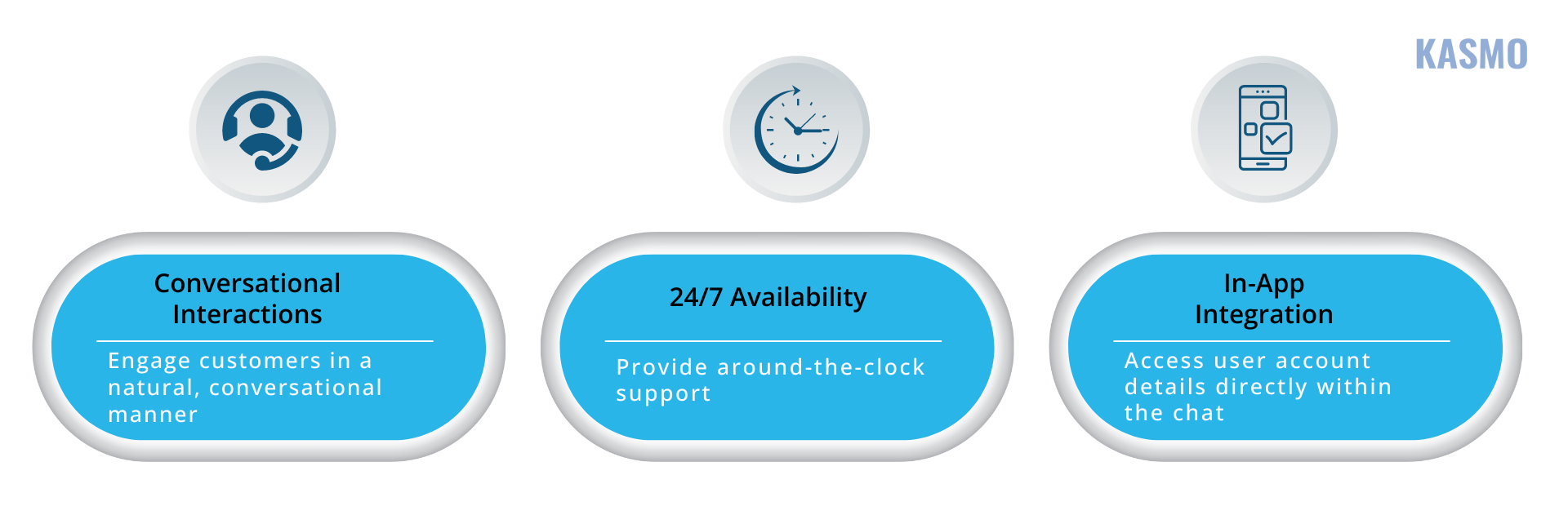

Leveraging Chatbots

Chatbots are effective for handling simple, routine queries like checking account balances or updating addresses. Here are some benefits:

Omnichannel Banking

A strong CX strategy must be omnichannel, ensuring consistent service across all platforms. Omnichannel solutions synchronize data in real-time, allowing customers to start a process on one channel and complete it on another seamlessly.

Enhancing the Banking Customer Journey

Journey mapping helps address critical questions. It helps banks meet the expectations of clients by assessing if the current experience meets customer expectations. Financial firms can identify areas for improvement, by determining which aspects need enhancement. Additionally, banks can provide innovative experiences by exploring new experiences that can set the bank apart. Financial firms should always consider customer motivations, actions, and barriers at each stage to improve the overall banking journey.

Utilizing Data and Analytics

Data drives personalized experiences. High-quality, relevant data enables targeted services and personalized communication. For instance, OLAF uses pre-fed financial data to offer tailored financial solutions in 107 languages. Learn More.

Personalizing Customer Experiences

To enhance personalization, banking institutions can do the following:

- Prioritize Customer Needs: Address questions directly and avoid pushing unsolicited services.

- Leverage Customer Data: Demonstrate knowledge of customers’ preferences and needs.

Integrating Physical and Digital Banking

Integrating physical and digital data can help enhance customer experience in banking. Due to huge volumes of data and outdated infrastructure, it becomes difficult for banks to consolidate all their data to a single point. Snowflake understands this problem and has created a Financial Services Cloud to centralize several types of data from various sources in a single repository.

Snowflake Marketplace offers robust data enrichment capabilities by integrating third-party data sources, including demographic, identity, macroeconomic, and geospatial. This feature allows organizations to enhance their datasets with external insights, improving their analytics and decision-making processes.

Data Security and Governance in Snowflake are designed to safeguard sensitive financial data. Key features include:

- Dynamic Data Masking: Protects sensitive information by masking it according to user roles and permissions.

- End-to-end Encryption: Ensures data is encrypted both in transit and at rest, maintaining confidentiality and integrity.

- Global Data Clean Rooms: Allow financial institutions to collaborate with external partners while keeping their customer data secure and private.

Here’s how to enhance customer service in banking by using Global Data Clean Rooms:

- Streamline Customer Acquisition and Onboarding: Improve efficiency and reduce friction in onboarding new customers.

- Create Customer-Centric Digital Experiences: Tailor digital interactions to meet individual customer needs and preferences.

- Identify Cross-Sell and Upsell Opportunities: Utilize insights from Next Best Action or product suitability to enhance sales strategies.

- Facilitate Personalized Financial Planning: Develop customized financial plans and portfolio strategies based on enriched data insights.

These functionalities enable financial services organizations to leverage external data while ensuring robust data protection and privacy.

Conclusion

Enhancing customer service in banking is crucial to increase customer loyalty. Proactive engagement, personalized service, and leveraging technologies like chatbots and omnichannel solutions can set financial institutions apart and reduce customer churn. Snowflake’s advanced AI data cloud platform ensures robust data security, dynamic masking, and Global Data Clean Rooms, enable banks to improve data-driven decision-making while ensuring privacy. By focusing on these strategies, banks can meet evolving customer expectations, streamline processes, and build lasting trust and loyalty.